Why Startups Benefit When Big Investments Come Later

- Jason Moss

- Aug 15, 2025

- 3 min read

How delayed funding can sharpen product-market fit and increase survival odds

Just launched your new business and need resources to ace direct marketing at lower costs with higher ROI?

Check out Salesfully’s course, Mastering Sales Fundamentals for Long-Term Success, designed to help you attract new customers efficiently and affordably.

In the rush to secure venture capital, many founders mistake early mega-funding for a golden ticket. Yet, as history shows, capital abundance before a product has matured can be as dangerous as being underfunded. The lesson from cases like Color Labs is stark: too much money too soon often accelerates a business’s missteps rather than its milestones.

In 2011, Color Labs raised $41 million before its photo-sharing app even launched. The hype was immediate. Downloads surpassed one million in months. But the product failed to meet user expectations—missing critical features and plagued by technical flaws. Instead of iterating, the team poured effort into acquiring more users. By late 2012, the app was gone, and $25 million of unused funding sat idle.

The Case for Strategic Delay

The Walton Family Foundation recently reported that startups make up 37.2% of businesses in Northwest Arkansas—outpacing the national average of 35.3%. Many of these companies rely on incremental capital rounds, forcing disciplined spending and sharper focus on market fit.

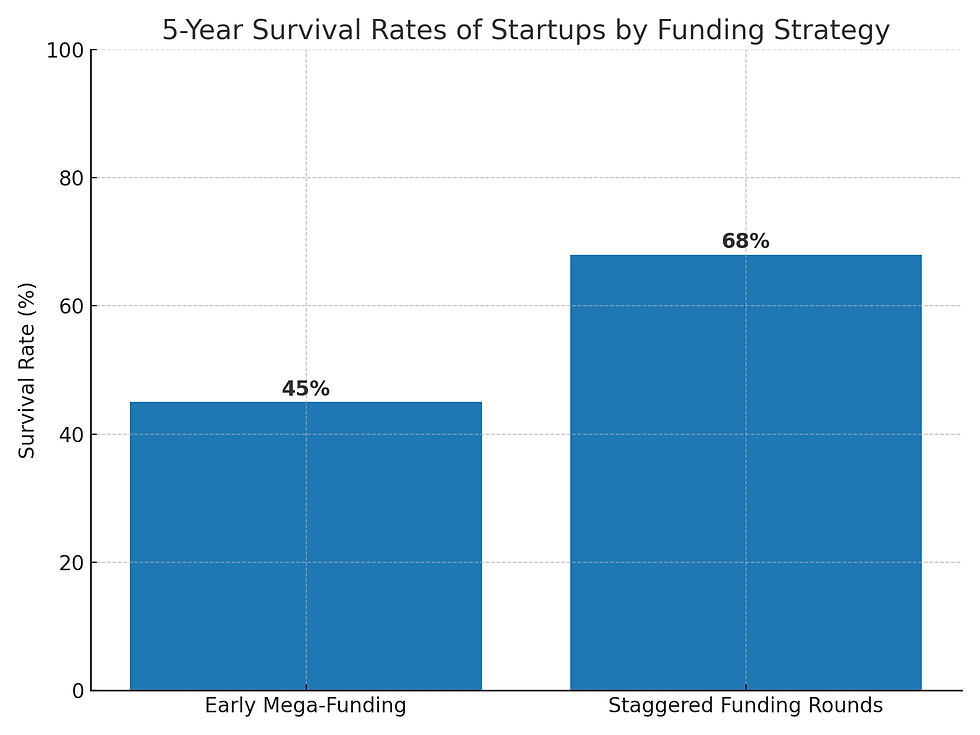

According to the Small Business Administration, 50% of small businesses survive beyond the five-year mark, but survival rates improve when founders spend the early years refining their product before seeking large capital injections. Startups with disciplined early-stage funding cycles tend to pivot faster, respond to user feedback more effectively, and avoid the pressure of meeting aggressive, investor-driven growth metrics.

A 2024 CB Insights study found that 42% of startups fail because there’s no market need for their product—a mistake often masked in the early stages by inflated marketing budgets.

Why Too Much Capital Can Backfire

Early mega-funding can create false security. Large cash reserves may tempt founders to overhire, overspend on marketing, or pursue features without clear market validation. This "runway illusion" can delay crucial course corrections until it’s too late.

Brad Feld, co-founder of Techstars, has noted: "Capital amplifies both the strengths and weaknesses of a startup team. Without a solid foundation, more money just makes the problems bigger."

The ability to self-correct is often strongest in the early, lean stages—when survival depends on it. Companies that raise later rounds only after achieving strong user retention metrics and proven revenue models tend to experience more sustainable growth.

A Smarter Funding Timeline

Instead of front-loading capital, a staggered funding approach can create natural checkpoints for accountability. Early funds go toward building and validating the core product. Later, once the market responds positively, larger rounds can scale operations without undermining agility.

The approach is gaining traction. Y Combinator has adjusted some of its investment guidance to encourage founders to reach early traction milestones before pursuing major Series A rounds.

A well-timed influx of capital can help a startup transition from scrappy survival mode to scalable growth—without losing its ability to adapt quickly to market changes.

Just launched your new business and need resources to ace direct marketing at lower costs with higher ROI?

Check out Salesfully’s course, Mastering Sales Fundamentals for Long-Term Success, designed to help you attract new customers efficiently and affordably.

Don't stop there! Create your free Salesfully account today and gain instant access to premium sales data and essential resources to fuel your startup journey.

.png)

Comments